What Gold, Silver, And Bitcoin Are Telling Us About Stock, Bonds, And Currencies

by: Andrew Hecht

- Gold and silver bull markets.

- Bitcoin - a validation of weak fiat paper currencies.

- Currencies all move lower.

- Bonds - interest rates are not going up. They are going lower.

- Stocks - it is a bad time to be overvalued.

- Bitcoin - a validation of weak fiat paper currencies.

- Currencies all move lower.

- Bonds - interest rates are not going up. They are going lower.

- Stocks - it is a bad time to be overvalued.

2016 has been a year for trading rather than investing. Over the first six weeks of the year, the S&P500 dropped 11.5%. By the end of the first quarter, it was back up and closed at the end of March with a 0.77% gain. At the end of June, the critical equity index had posted a 2.69% gain on the year. Those who held their noses and bought the dip that took the market to lows on February 11 profited handsomely, so far.

So many retirement and investment accounts mirror the performance of the S&P 500 index and the index put in a respectable performance after the carnage seen during the first month and a half of this year. However, there are some ominous signals that the second half of the year could be difficult for equity markets. In fact, other markets could be telling us that dark clouds are gathering, and stocks could be in real trouble in the weeks and months ahead. It is an excellent time to take stock of those stock positions, in a couple of weeks your portfolio results for 2016 could look a lot different than they do today.

Gold and silver bull markets

Fear and uncertainty have gripped markets across all asset classes in 2016 increasing volatility. The action in precious metal markets has been a direct result of the volatile nature of the political and economic landscape around the world.

Early in the year, the gold market gave the first indication that something was underfoot. Gold rallied out of the gate in 2016 while many other commodity markets had yet to make significant multi-year lows.

As the weekly chart highlights, COMEX gold futures opened 2016 around the $1060 per ounce level. Last week gold traded to highs of over $1375 per ounce, the highest level since March 2014. The over 29% increase in the price of gold has been a sign that investors and traders have sought safe-haven assets for their capital.

The action in silver, a more speculative precious metal, has been even more impressive.

The weekly silver chart illustrates that the precious metal that opened at the beginning of 2016 at the $13.80 per ounce level appreciate to highs of over $21 last week, an increase of 52%. The price increases in both silver and gold have been validated, from a technical perspective, by the rise in open interest to all-time highs. Open interest is the number of open long and short positions in the futures market and the increase in market activity over recent months has been proof of the fear and uncertainty that prevails in markets. Last Friday, after a strong employment report the prices of both gold and silver corrected lower only to bounce back higher later in the session; a sign of real strength.

Bitcoin- a validation of weak fiat paper currencies

Gold and silver have a long history as hard assets or real money. In fact, these precious metals have been around as means of exchange or currencies long before any of the current currencies of the world existed.

Over recent years, a new form of currency has captured the attention of many around the world.

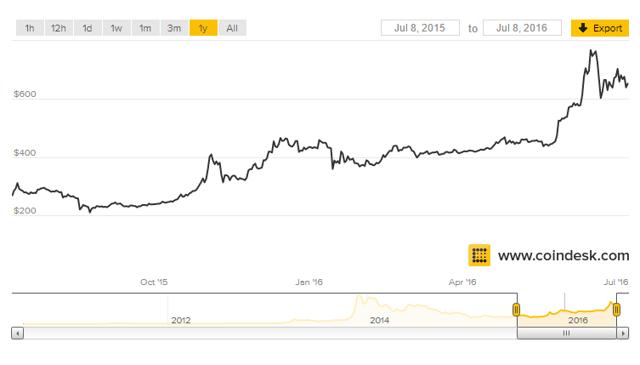

Cryptocurrency is a computer-based means of exchange that become more popular particularly with the millennial generation. Bitcoin is the dominant cryptocurrency, and it has appreciated dramatically over recent months.

As the annual chart of Bitcoin shows, it has moved from $430.05 on December 31, 2015, to over $652 as of last Friday, an increase of over 51%.

Gold silver and Bitcoin all have one thing in common; central banks and monetary authorities around the world cannot create more of these currencies as they are truly pan-global means of exchange. The price action in all three is telling us something significant about the current state of the global economic and political landscape.

The Carden Smart Wealth Indices provide an emotion-free view of markets and can dampen volatility when market activity flashes warning signs. These indices may serve as excellent predictive tools at a time when alternative assets are flashing ominous signals to markets.

Currencies all move lower

The weekly chart of the U.S. dollar index shows that the greenback has appreciated against all the key currencies since May 2014.

A stronger dollar is traditionally bearish for the value of gold and silver as well as other hard assets. However, in 2016 these precious metals have taken off to the upside despite the fact that the dollar remains far above levels seen in 2014. If gold, silver and Bitcoin have rallied in dollar terms, it means that they have exploded in other currencies as the other main foreign exchange instruments remain weak against the U.S. currency.

In 2016, we see a decline in the values of all paper money when compared to precious metals and the cryptocurrency.

Bonds- Interest rates are not going up, they are going lower

The debasement of currency values around the world is a direct result of the central bank monetary policies. Since the global financial crisis in 2008, policies of slashing interest rates and quantitative easing or buying back debt by central banks have become the norm. The U.S. QE policy ended over a year ago, but interest rates remain just above zero after the first rate hike in nine years last December. The Fed promised to increase rates 3-4 time in 2016 but because of a myriad of domestic and foreign economic issued that have yet to act.

In Japan and Europe, interest rates are in negative territory. The Chinese economy has slowed.

In the summer of 2015, Europe faced a default by the Greek government. The bailout put additional strains on the European economy. A massive refugee influx from the Middle East and North Africa into Europe has made a bad situation worse when it comes to Europe's struggling economy. Most recently, the U.K. voted to exit the European Union, which led to a precipitous drop in the value of the pound and worries about other member nations leaving the Union. Now it appears that Italian banks are in a financial mess, and whispers of an Italian exit from the E.U. have stoked new fears of a total breakup and breakdown in economic order.

All the while, government bond prices have been climbing given the artificial put option in place by the central banks of the world.

The quarterly chart of the U.S. 30-year bond speaks for itself.

Central banks are running out of monetary tools fast. The two most prominent central bankers in the world, Europe's Mario Draghi, and the Fed's Janet Yellen have been cautioning government leaders that monetary policy by itself is not sufficient without fiscal policies to stimulate the economy, reduce saving and increase borrowing and spending. Talk of helicopter money has slowly been creeping into the discourse from central bank officials and respected economists.

Meanwhile, while interest rates are at the lowest level in history, the easy money policies have been hampered by the banks that have tightened credit policies. The only people that can borrow in this environment are those who do not need the money. The catch-22 of the current state of monetary policy has left central bankers and government officials scratching their heads on what to do next. The one thing they all seem deathly afraid of is abandoning accommodative policy for fear that it will throw the global economy into a brutal recession.

In the wake of Brexit, it appears that interest rates are once again heading lower and further into uncharted waters. Low rates have caused capital to find any home possible as the debt markets offer little, no or negative yields around the world.

Stocks- It is a bad time to be over-valued

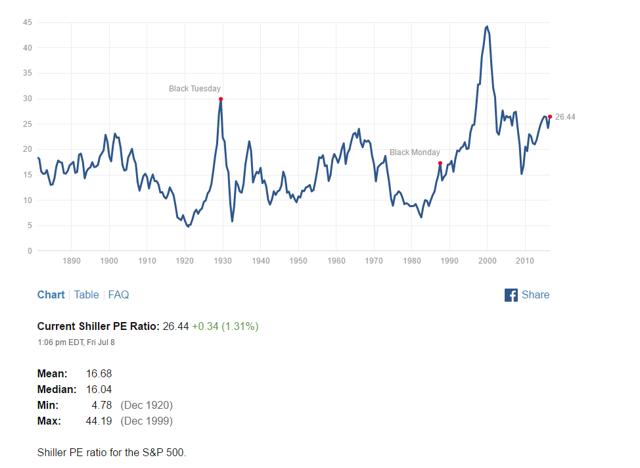

Money continues to flood the equity markets with interest rates at such low levels. Last quarter, corporate earnings were less than exciting. At the same time, stock prices are trading at rich multiples compared to past years.

The CAPE ratio is far higher than its mean and median levels dating back more than 100 years meaning equity valuations are too high. Given the current state of the global economy, they may be not only high but in bubble territory. Capital growth in the equity markets is dependent upon earnings. The current economic landscape makes it tough for companies to grow revenues. Therefore, many have turned to stock buyback programs or trimming expenses to pump up short-term profits and share prices. This merry-go-round cannot go on forever, and economic conditions must improve, or we will begin to see massive downdrafts in stock prices and the flow of money into equities will stop. We have already seen two such stock market tremors in August of 2015 and at the beginning of this year. Those tremors could be the harbinger of what awaits us in the months ahead.

Currency values are questionable given the appreciation of gold, silver and Bitcoin over recent months. Bond prices have risen to a level where a concrete ceiling is in place, and the only reason they are so high is that governments keep printing more money to buy more bonds and keep interest rates low for the very few with the ability to borrow. Meanwhile, stock prices are at levels that would be high even if the global economy was chugging along in healthy fashion, which is it not.

Precious metals are an effective fear barometer. It is a scary time in the global economy, and the citizenry of many countries are voicing their concerns at the polls as we just witnessed in the United Kingdom. The trend of political change at a time when economic foundations appear so weak could add more volatility to markets in the weeks and months to come with the U.S. Presidential election on the horizon. That is what gold, silver and Bitcoin are telling us about the global economy. It is only a matter of time before stocks, bonds, and currencies begin to crumble under the weight of pressure and artificial central bank accommodation.

0 comments:

Publicar un comentario