The Consumer Mirage

- The strength of the U.S. consumer is often cited as justification for the recent stock market rally.

- Yet the strength of domestic consumer stocks are not as strong as they seem.

- In fact, in many cases, their stock price performance has been poor.

- Such relative weakness may present upside opportunity in some cases, but also raises questions about the outlook for the U.S. consumer going forward.

At First Glance

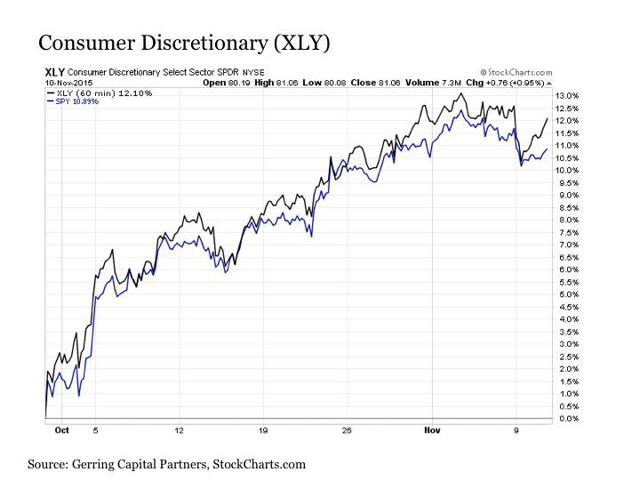

On the surface, the consumer discretionary sector (NYSEARCA:XLY) appears to be a strong driving force of the recent stock market rally. The sector consists of retailers, apparel companies, restaurants, automobiles and media companies among others. And since the latest market bottom at the end of September, it has moved in tandem with the broader market.

(click to enlarge)

The Optical Distortion Under The Surface

It is with the very first look under the surface of the consumer discretionary sector that we begin to unearth the illusion of the strong consumer and its driving force in the recent rally.

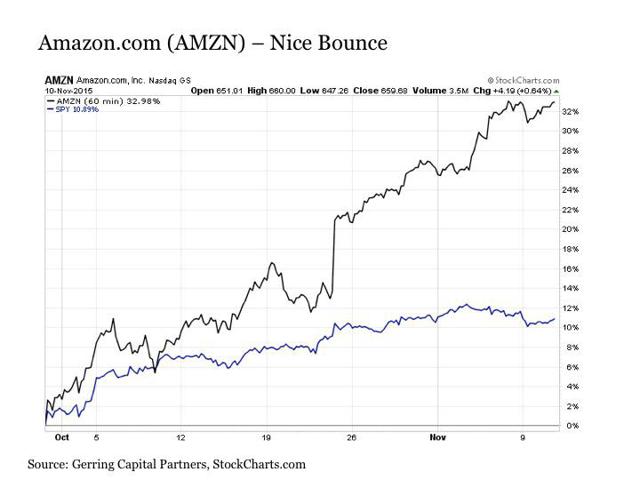

Amazon.com (NASDAQ:AMZN), which is by far the largest weight of the XLY at 10.48% of the sector, has posted returns that have more than tripled the broader market since the end of September.

(click to enlarge)

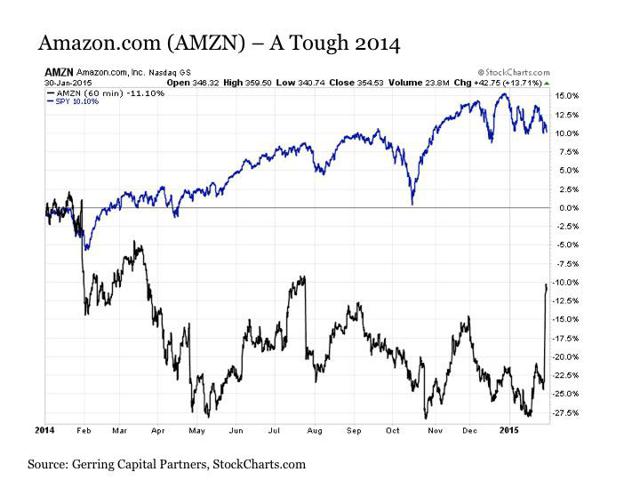

So how does the strength of Amazon.com undermine the strong consumer thesis? After all, this is the company that is the future of consumer retail spending, so is not its recent stock price surge simply evidence of a strong consumer? Perhaps. But if this is truly the reason, wouldn't then the near -30% decline in Amazon.com from January 2014 to January 2015 have implied that the domestic consumer was retreating to a bunker?

(click to enlarge)

Yet the narrative at the time remained the same that the domestic economy and the health of the consumer was in part what made the U.S. the cleanest dirty shirt around the stock market world. In other words, the performance of Amazon.com's stock whether good or bad should not be viewed as a barometer for the domestic consumer. Instead, it is a momentum stock that is prone to wide deviations from the broader market at any given point in time.

As a result, it is worthwhile to look past Amazon.com to see what the remaining 89.52% of the sector might be telling us about the domestic consumer. Unfortunately, much of the rest of the sector has not been lifted by the same tide that has catapulted Amazon.com off of the recent lows. On the contrary, if we are to read anything into the price performance of many leading consumer related stocks, it is a story not of strength but of caution and concern.

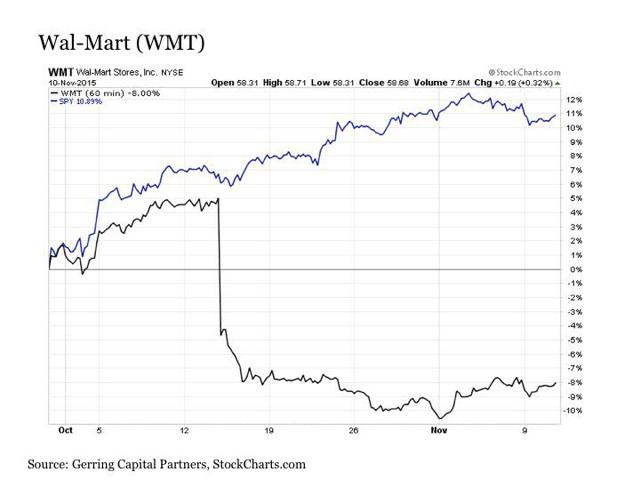

We will begin with a stock that is actually technically part of the consumer staples sector but worth noting nonetheless given its status as America's largest retailer and employer. This company, of course, is Wal-Mart (NYSE:WMT). And the price performance of the stock relative to the broader market is disconcerting to say the least. Yes, the analyst meeting fail that took place in mid October did not help the stock, but it's not as though it has perked up in the weeks since the gap lower.

(click to enlarge)

But perhaps this is simply Wal-Mart going through a long-term strategic transformation story. What about the rest of the retailers? Unfortunately, if the stock price performance of retailers since the market bottom in September is any indication of consumer health, it is a troubling story to say the least.

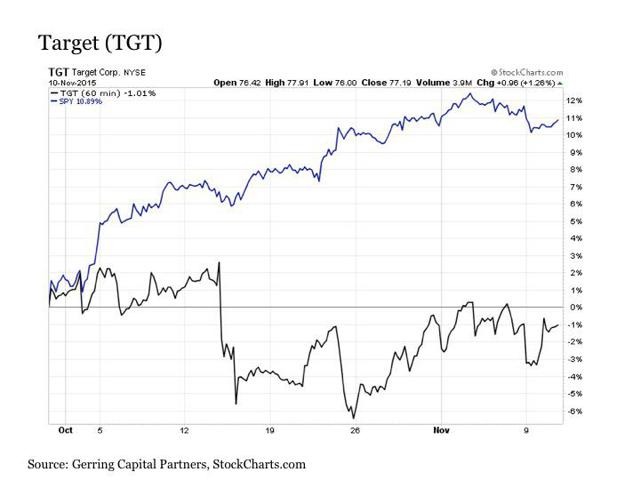

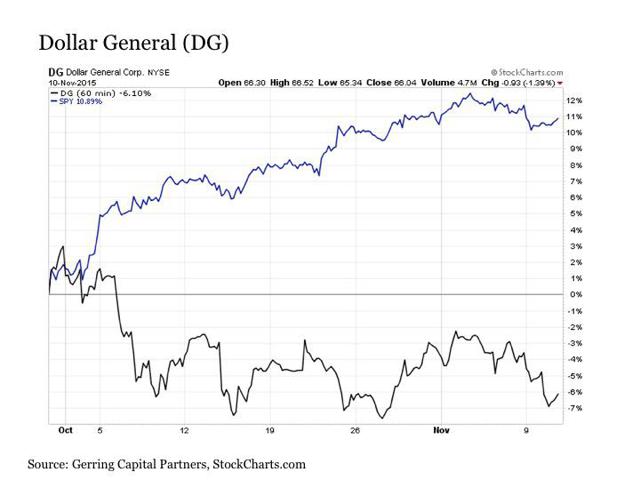

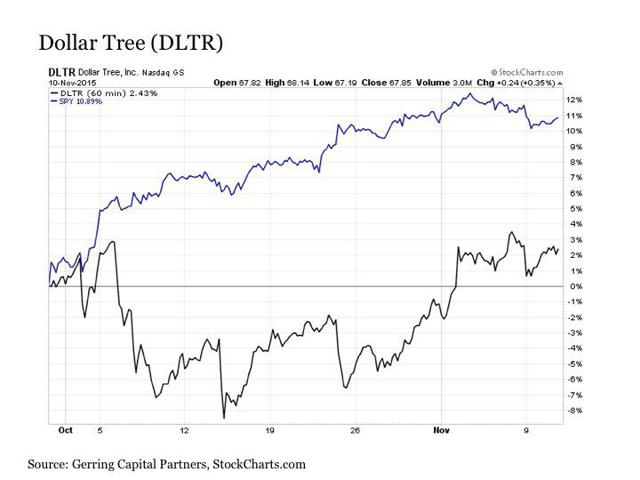

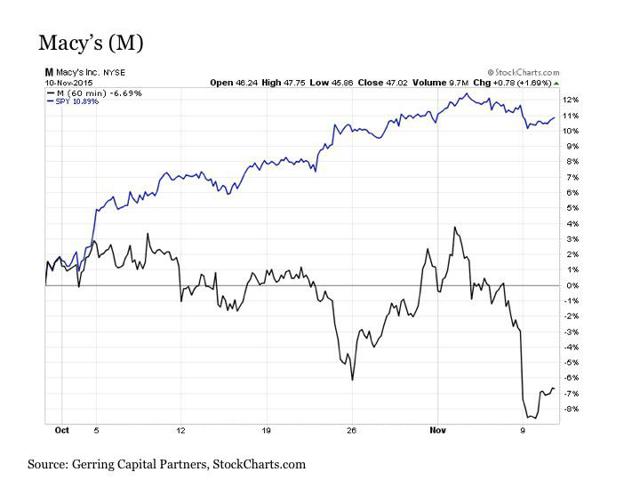

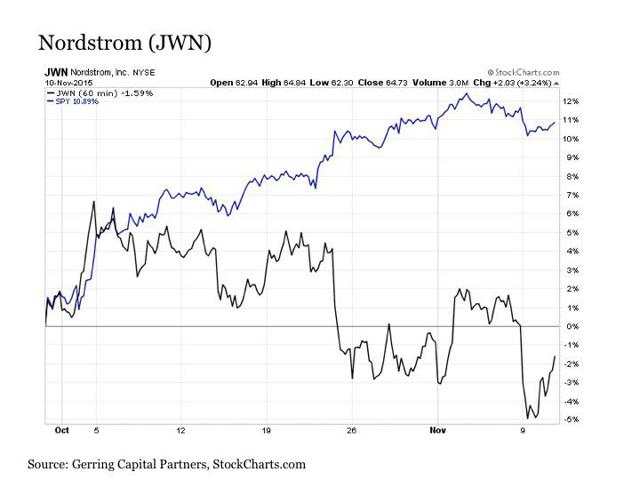

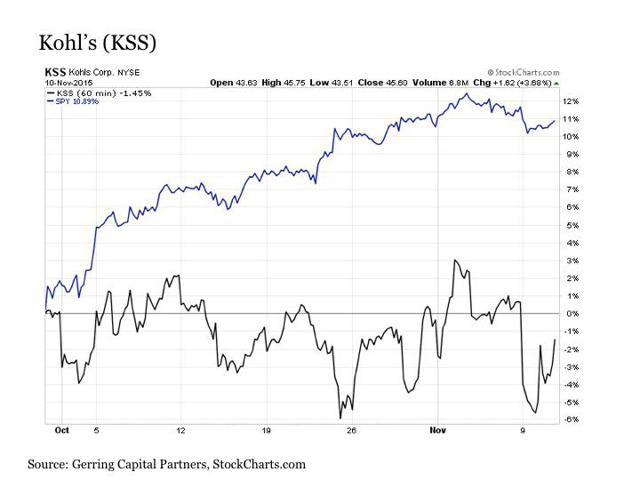

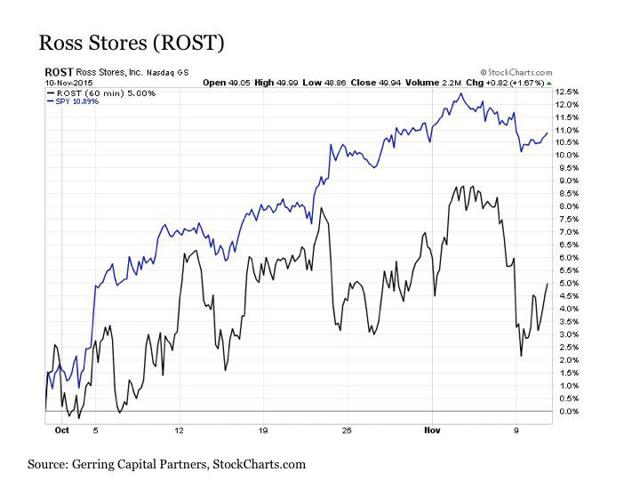

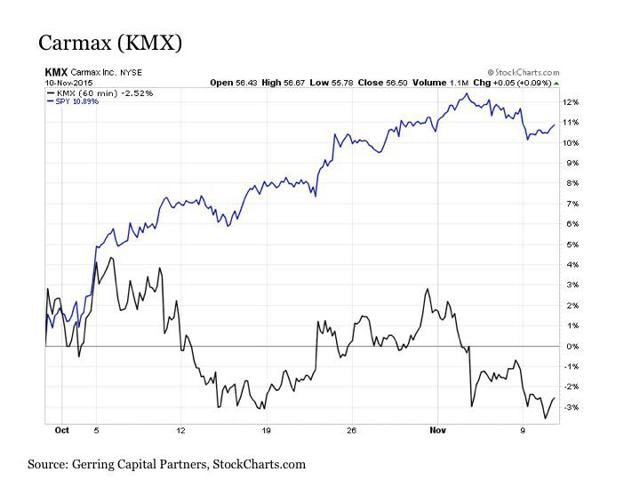

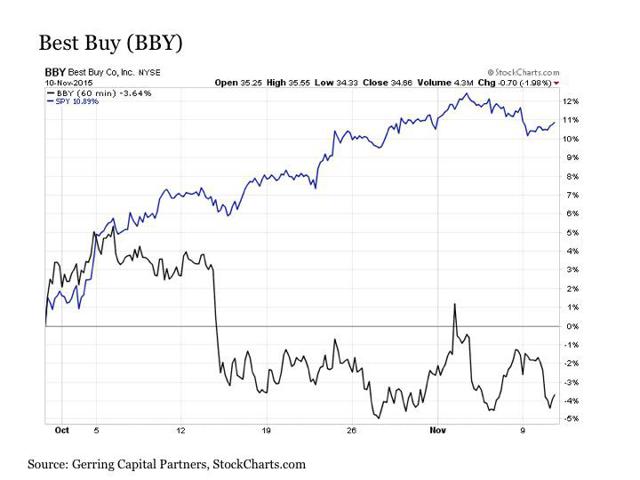

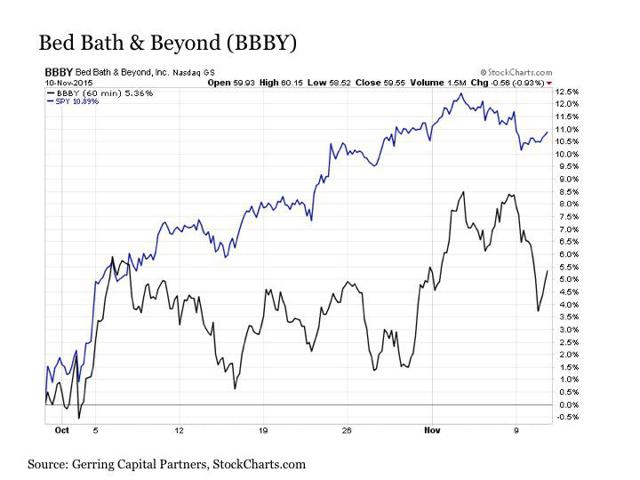

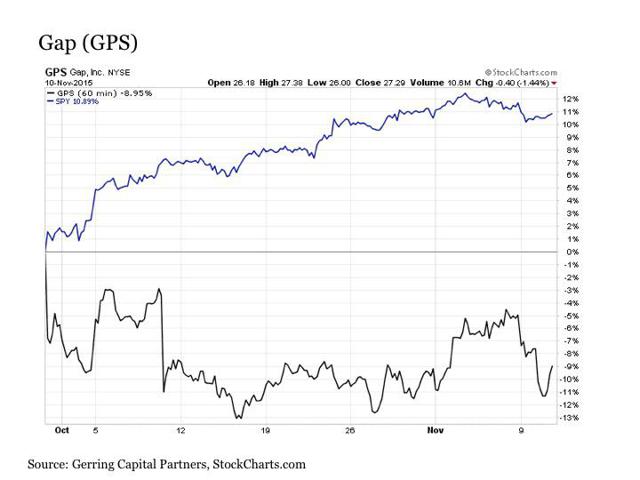

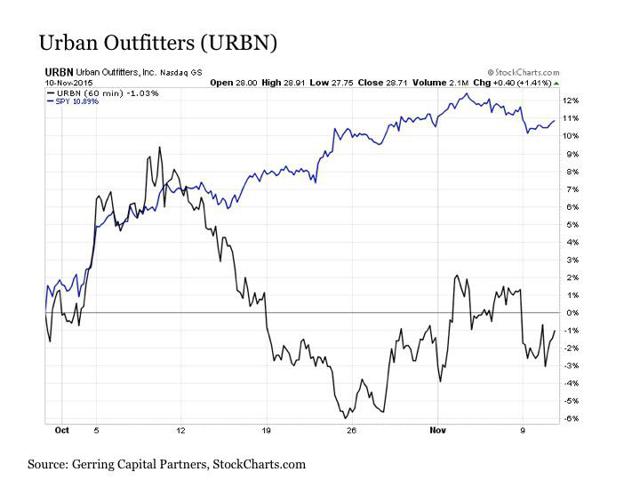

The following is a series of stock price charts for a broad range of retailers across all shapes and sizes including Target (NYSE:TGT), Dollar General (NYSE:DG), Dollar Tree (NASDAQ:DLTR), Macy's (NYSE:M), Nordstrom (NYSE:JWN), Kohl's (NYSE:KSS), TJX (NYSE:TJX), Ross Stores (NASDAQ:ROST), CarMax (NYSE:KMX), Best Buy (NYSE:BBY), Bed Bath & Beyond (NASDAQ:BBBY), Gap (NYSE:GPS) and Urban Outfitters (NASDAQ:URBN).

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge)

In all cases from names across the retailing spectrum, these stocks have not risen along with the broader market. In every case, they have lagged meaningfully behind. And in many instances, they have fallen in value at a time when the broader market has risen by double digits. Needless to say, this is not a sign of consumer strength at all.

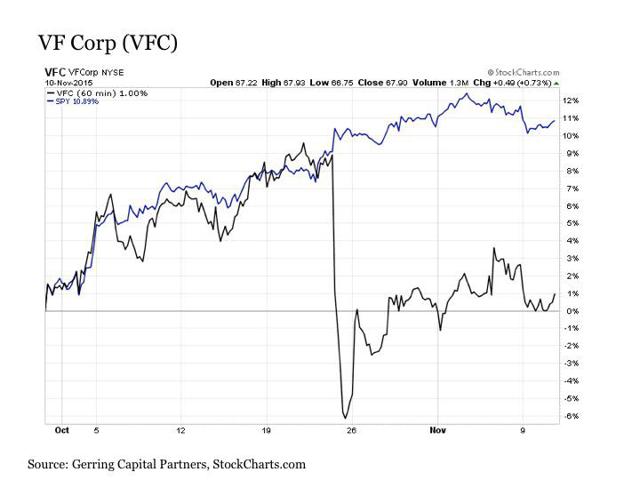

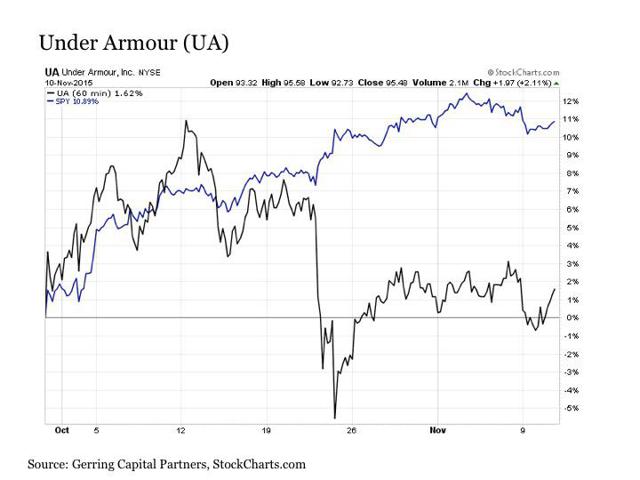

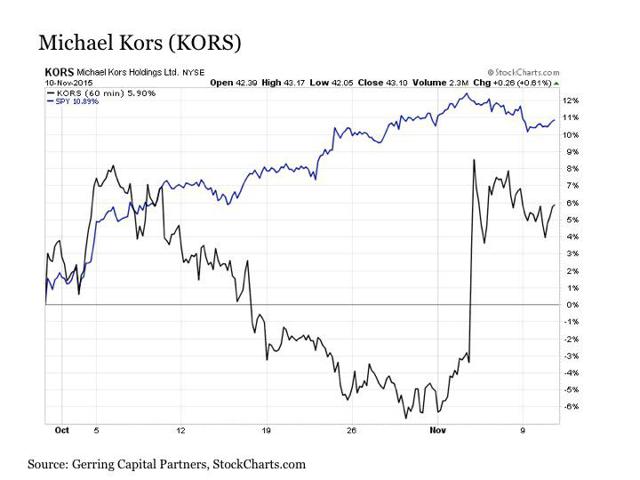

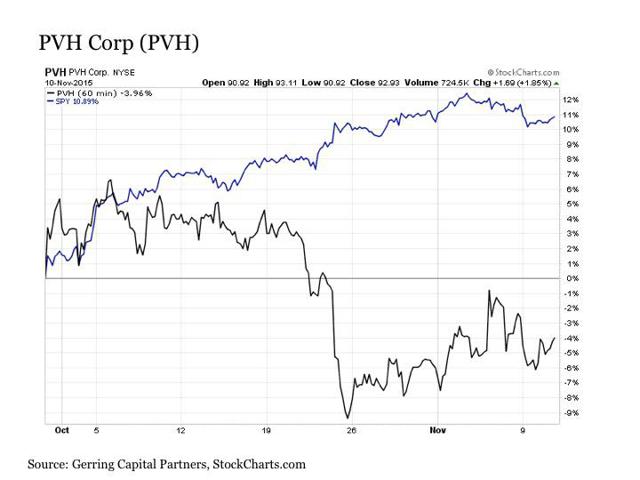

A similar story can be told about some of the products that consumers are going to the stores to buy. Let's begin with the apparel companies. It should be noted that leading apparel companies like Nike (NYSE:NKE) have risen along with the broader market. But it is just as notable that many more have been struggling since the end of September.

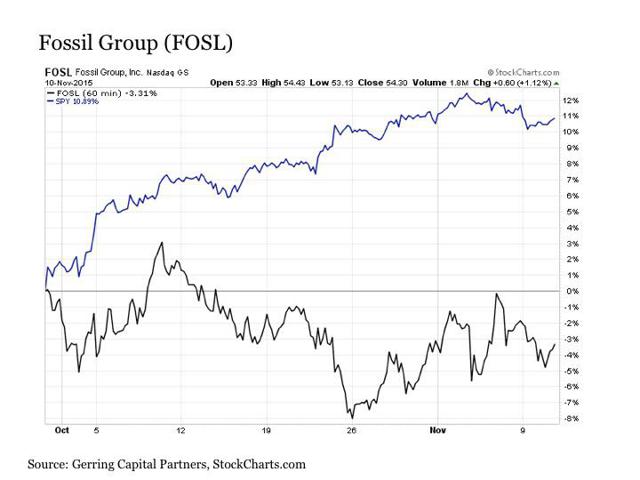

The following is a series of price charts for various apparel companies including VF Corp. (NYSE:VFC), Under Armour (NYSE:UA), Michael Kors (NYSE:KORS), PVH Corp. (NYSE:PVH) and Fossil Group (NASDAQ:FOSL).

(click to enlarge)

(click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

Once again, none of these companies have risen along with the broader market since late September. And most are trading flat if not in negative territory in recent weeks.

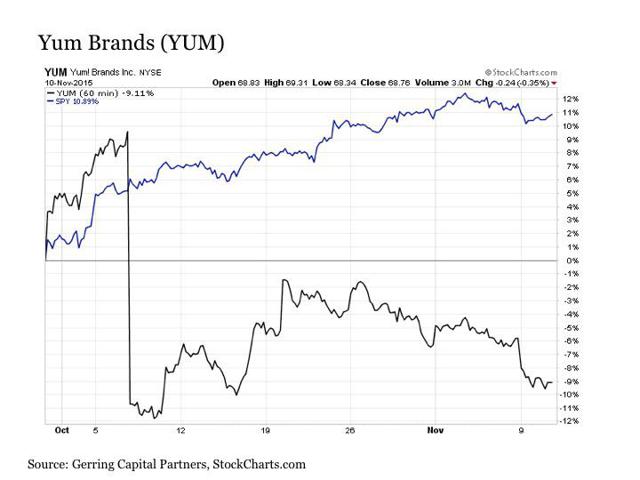

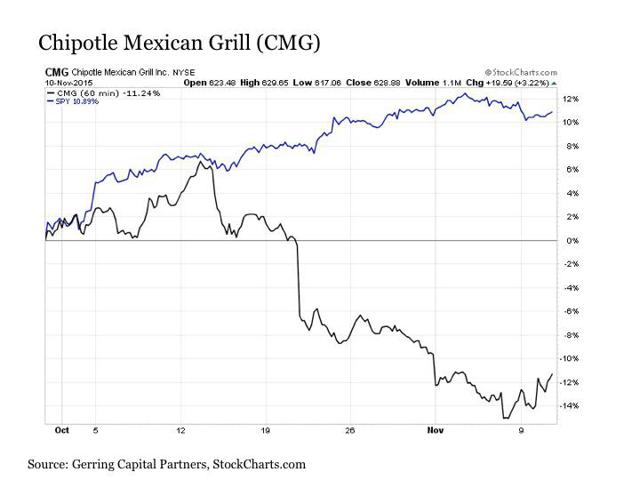

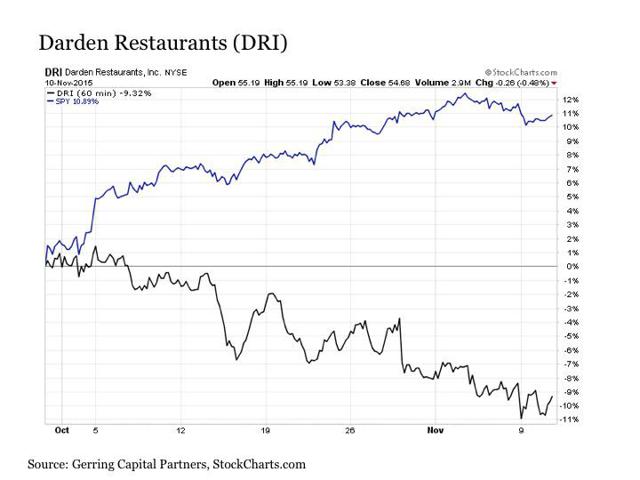

Moving on to restaurants, the song remains the same. For a while, big chains such as McDonald's (NYSE:MCD) and Starbucks (NASDAQ:SBUX) have certainly performed well during the recent rally, a number of others have been relatively dismal. The following are price charts for Yum Brands (NYSE:YUM), Chipotle Mexican Grill (NYSE:CMG) and Darden Restaurants (NYSE:DRI). In each case, recent price performance has not only trailed the market but has been downright poor.

(click to enlarge)

(click to enlarge)

(click to enlarge)

The Bottom Line

If stock price performance of the consumer discretionary sector is supposed to be a reflection of the health of the domestic consumer, it is far from a decisively positive story to say the least. For the handful of giant companies by market cap that are performing well during the recent rally, many more have been struggling at flat to negative over this same time period.

The optimistic investor might view this relative price weakness as an attractive buying opportunity. And perhaps this will indeed be the case in the end, as these may very well represent a roster of names - high quality in many instances - that are worth exploring for potential upside as part of an overdue bounce back.

But the realist investor might consider that these wide deviations are a sign of concern that the U.S. consumer may not be capable of and/or interested in spending as much as they have in the past. And with personal consumption expenditures making up roughly two-thirds of the entire U.S. economy, such weakness if it does indeed exist does not necessarily bode well for the supposedly strong American economic outlook and the broader stock market that supposedly depends on it.

0 comments:

Publicar un comentario