Getting Technical

MONDAY, JANUARY 10, 2011

Commodities are Not Done Yet

By MICHAEL KAHN

From corn to coffee to palladium, technical evidence points to higher prices in the coming months.

With gold sinking more than 50 bucks an ounce last week, gold bears and bubble mongers were crowing that the top is in. I beg to differ.

Just a quick perusal of the long-term charts for gold and other commodities show that the bull market is far from endangered.

From corn to coffee to palladium, technical evidence points to higher, not lower, prices in the coming months.

To be sure, many commodities have short-term problems and likely still need to work off some of their overly bullish froth. And stock sectors related to commodities, such as energy, do indeed look a bit stretched too far in the short-term. But once respective corrections are over, I suspect we'll see many set up for another leg up.

As with gold, the SPDR Gold Trust (GLD) had a rather scary start to the year (see Chart 1). With three failed attempts to breach the 140 level over the past two months, some chart watchers label the pattern as a bearish-leaning "triple top." Others might see a bullish-leaning "ascending triangle" due to its flat top and rising bottom border.

Chart 1

GOLD ETF

My view is the period from early November through today is more of a ragged trading range thanks to extremes in opinions among bulls and bears. The former cite inflationary money printing by the Fed while the latter looks at deflationary pressures in housing and wages. But the charts are not concerned with these fundamental reasons and rather than try to fit a pattern to the market I'd prefer to give it some latitude.

Given that view, support at the bottom of the range, roughly at 130 for the ETF and 1320 for gold itself, seems to be a good place for the market to reveal its intentions. That is where the bottom of the ragged trading range meets the rising trendline from the November 2008 low.

Crude oil started the year well on its way to reaching the $100-per-barrel level. Unfortunately, that target was widely expected and as the market often does it throws exuberant bulls a curve ball – and a price correction. But as with gold, both the multi-month and two-year rising trendlines are still intact and that means we have to give the bulls the nod.

Phil Flynn, senior market analyst at PFG Best, offered some evidence that does work a bit against the market reaching $100 right away. He observed that after the weekend shutdown of the Alaska pipeline, oil prices had the opportunity to soar Monday, but the initial reaction was muted. Modest reaction to news that is potentially very bullish suggests that the market is not yet ready to move much higher.

Therefore, the bulls do remain in control, but we have to wait for the market to work out its kinks, first.

Agricultural commodities also remain technically strong for the long-term. And even from the fundamental side, the monthly Food Price Index published by the United Nations Food and Agriculture Organization that global food prices reached a record in December, above a previous high set in 2008.

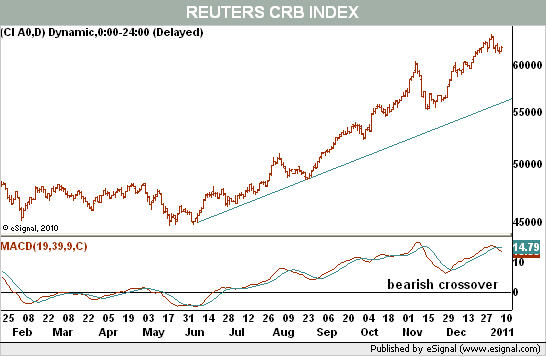

On the charts, the Reuters CRB index using the original, agriculturally-heavy formulation remains in a long-term bull market (see Chart 2). As December ended, it confirmed the fundamentals as it also moved to an all-time high, eclipsing its 2008 peak.

Chart 2

REUTERS CRB INDEX

Here, too, the trend is showing signs of short-term exhaustion with several momentum indicators beginning to wane. It does indeed have room to correct to reach its rising long-term trendline and similar conditions are evident in component commodities such as corn, wheat, coffee and cotton.

However, trend exhaustion does not mean imminent trend reversal and long-term bull market trends remain intact.

For now, commodities bulls are on hold. For the longer-term, I see no technical reason why the bull market is over.

Michael Kahn, mutual fund co-manager, author of three books on technical analysis, former Chief Technical Analyst for BridgeNews and former director for the Market Technicians Association, also blogs at www.quicktakespro.com/blog.

Copyright 2010 Dow Jones & Company, Inc. All Rights Reserved

Home

»

Commodities

»

Gold

» COMMODITIES ARE NOT DONE YET / BARRON´S GETTING TECHNICAL ( HIGHLY RECOMMENDED READING )

martes, 11 de enero de 2011

Suscribirse a:

Enviar comentarios (Atom)

0 comments:

Publicar un comentario