Dear Reader,

Welcome to the weekend edition of Casey's Daily Dispatch, a compilation of our favorite stories from the week for the time-stressed readers.

What the Deflationists Are Missing

An interesting article by Ambrose Evans-Pritchard came my way the other morning. It’s worth a read, if for no other reason than that he paints an appropriately dark picture of the current state of the U.S. economy. You can read it in the blog under Jan. 13 titled "America slides deeper into depression as Wall Street revels"(http://gonzaloraffoinfonews.blogspot.com/2010/01/america-slides-deeper-into-depression.html.)

While I very much share Mr. Evans-Pritchard’s view that the global economy is far from out of the woods, our views diverge in that he sees devastating deflation speeding our way down the tunnel. Readers of any duration know that we here at Casey Research see devastating inflation.

While we could both be right, with deflation first and inflation later, I’m not so convinced.

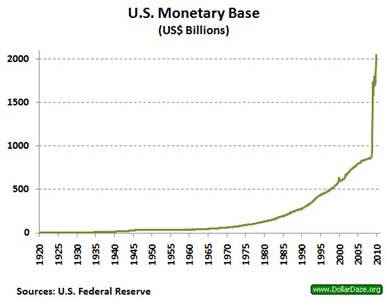

For starters, there is already a massive inflation operation being run by the Fed, evidenced in a historic spike in the monetary base over the last two years. And the Obama administration is far from done.

And the Obama administration is far from done.The Democrats’ reinvigorated focus on jobs – the single most important factor in this November’s elections – will soon translate into a flurry of new initiatives designed to put people back to work, most of it funded at taxpayer expense.

To believe in the deflationary case would seem to require believing that Obama and his minions are ready to forgo any further political aspirations by collectively putting their feet up on their desks for the balance of their sole term at the apex of global power.

Given Obama’s meteoric rise to power – evidence that he possesses a certain drive and competence in the game of politics – that seems highly unlikely. And so it seems safe to assume we’ll soon witness a redoubling of his efforts to keep interest rates down to make it easy and cheap for strapped consumers and businesses to keep borrowing and to otherwise flood the economy with money.

In a deflation, the value of the money increases – which is actually a pretty desirable thing, if you ask me. Inflation, by contrast, means that pretty much everything you own in the local currency steadily loses value – forcing investors into a perpetual game of catch-up. It’s hard for me to calculate how the government can dramatically increase the money supply and yet have each of the currency units become increasingly more valuable over a sustained period of time.

Arguing against that point, Evans-Pritchard makes the case that the U.S. government is making much the same mistakes that were made in the first part of the Great Depression, i.e., being overly tight with the money. And that the velocity of money is falling.

There are a couple of key differences between now and then, however. First, the Fed didn’t actually know what the money supply was back then. They literally had no monitoring tools in place, mostly because no one thought it was important enough to track. Second, they didn’t have fiat monetary powers. Today, neither of those factors apply.

Everyone knows what the money supply of the U.S. is and watches it keenly. Including our foreign creditors. And so it is not surprising to see the Fed publicly talking about tightening up a bit. But it’s just talk at this point.

With the economy continuing to struggle, the only reasonable assumption that can be made is that the Fed – in cahoots with the entirely politicized Treasury – will keep shoveling money onto the economic embers, and continue to do so until economic activity again flares up.

That will, of course, require increasing the quantity of money that actually makes it into the economy – but that should be child’s play for Team Obama – with direct hiring and spending, continuing to buy mortgages and other loans to suppress interest rates, forgiving the bad debts of banks, or changing accounting rules so that banks can postpone reckoning day. And that’s just for starters, all of it packaged nicely in the name of the public good.

And once the money starts to flow, there will be a pick-up in economic activity, which will beget yet more money moving around. At first, this money will be a palliative for the economic worries, but then comes the inflation – a small trade-off, the politicians will decide, if it buys them enough of a recovery to make it through the November elections and get the president the second term you know he so strongly desires.

There is something else that I think the deflationists are missing, and that has to do with confidence in the currency. If the U.S.’s many creditors come to agree with our point of view – that the dollar is being led to the altar as a sacrificial lamb to political expediency – then they’ll further reduce their purchases of our Treasuries and start trading their dollars for stronger currencies and tangible assets, including precious metals.

At that point, interest rates will have to begin rising to attract new buyers. As you can see in the chart of long-term Treasury bond rates, a significant move off recent lows has already occurred, and rates are looking poised for a breakout to the upside.

Of course, the higher those rates ratchet, the more it will cost the U.S. government to carry its massive debt. While rising rates will continue to drive demand to the short end, suppressing those rates, in time the sheer quantity of paper that will have to be rolled over, and the rising tide of inflation, assures that short-term rates will have to rise too. At that point, the train begins to leave the track.

As the train wreck approaches, the government is going to have to find creative new ways to fund its social contract with impatient voters. Perhaps, for instance, pegging everyday fines and assessments to the amount of income a person makes. Executed brashly, such policies might even allow the government to charge a person of means, say, $290,000 for a speeding violation.

I know what you’re thinking: C’mon, let’s be realistic – that could never happen. Think again.

Europe slapping rich with massive traffic fines

By FRANK JORDANS

The Associated Press

Sunday, January 10, 2010; 11:30 AM

GENEVA -- European countries are increasingly pegging speeding fines to income as a way to punish wealthy scofflaws who would otherwise ignore tickets.

Advocates say a $290,000 (euro203,180.83) speeding ticket slapped on a millionaire Ferrari driver in Switzerland was a fair and well-deserved example of the trend.

Germany, France, Austria and the Nordic countries also issue punishments based on a person's wealth. In Germany the maximum fine can be as much as $16 million compared to only $1 million in Switzerland. Only Finland regularly hands out similarly hefty fines to speeding drivers, with the current record believed to be a euro170,000 (then about $190,000) ticket in 2004.

The Swiss court appeared to set a world record when it levied the fine in November on a man identified in the Swiss media only as "Roland S." Judges in the eastern canton of St. Gallen described him as a "traffic thug" in their verdict, which only recently came to light.

"As far as we're concerned this is very good," Sabine Jurisch, a road safety campaigner with the Swiss group Road Cross.

Or maybe the government will force you to convert some or all of your IRA or 401(k) into Treasuries, perhaps packaged up in an annuity. You’d be given the choice of making the switch or making a withdrawal and paying all outstanding taxes at that point. This is something that Doug Casey has warned about for several years now.

The seeds of that possibility may be headed for the soil: the following article from BusinessWeek reveals that the Treasury is now looking very hard at the trillions in retirement accounts and trying to figure out new ways to “help” the owners of those accounts.

In my view, what’s important in this little dissertation can be summed up as follows:

1. The current administration and its congressional allies have powerful political motives to soak the economic soil with fresh dollars. The Christmas Eve announcement that the Treasury is removing the $400 billion cap on losses it will cover for Freddie and Fannie is a classic example of how far they are willing to go to keep the money moving.

2. Unlike the Great Depression, the U.S. is now on a fiat money system – which is purpose-built for the current scenario. Open the taps, and if that doesn’t work, open them even wider. Failing to do so would be political suicide, and Obama and his team are just not into the idea of serving a single term.

3. Given the size of foreign holdings of U.S. dollars, the nation is faced with a “rock and a hard place” situation, where a sharp loss in confidence on the part of our creditors would likely lead to a currency crisis that drives the value of the dollar quickly lower, at the same time that it drives interest rates higher.

Something will have to give. We think that something will ultimately be the U.S. dollar, as it’s politically more acceptable to have a failing dollar than a smoking hole where the economy used to be.

Before this thing is over, I would not be surprised to see a new currency regime adopted that introduces exchange controls and a different category of dollar to be issued for the purpose of paying back foreign creditors. Such a dual-track currency system is nothing new but has been used by desperate regimes numerous times throughout history.

Forecasting the future is actually impossible, as there are just too many variables. But that doesn’t mean that we can’t step back and make certain logical assumptions about the policies the politicians are most likely to deploy in their efforts to retain power.

In the case of today’s world, the only politically logical decision will be to keep on spending until that spending itself becomes a pressing problem, at which point the politicians will turn their attention to “solving” the newest in a long list of problems they have created.

At which point they will no doubt find some creative way to blame the inflation on speculators, profiteers, and the free market.

(As much upside as the precious metals offer in a new era of rising inflation, the precious metals stocks will greatly outpace them. For over 28 years, Casey’s International Speculator has followed the best of the best high-octane exploration companies, inexpensive stocks with great management teams and true fortune-building potential.

What About Employment?

We often address unemployment in this missive, but we don’t often address the other side of the coin. So, what’s going on in the employment world?

The chart below shows total nonfarm employment and private employment on the left axis and government employment on the right axis. You can see here that over the past three years, total nonfarm employment and private employment has trended lower, while government employment has trended higher. Here are the specifics:

Here are the specifics:

• Total nonfarm employment is down 4.6% since January 2007, reflecting a decline of 6.27 million jobs.

• Private-sector employment has fallen 5.8% and lost 6.625 million jobs.

• Total government employment climbed 1.6% over the past three years and added 355k jobs.

• Meanwhile, federal government employment (not shown on the chart) rose 3.7% and tacked on 100k jobs over the analyzed period.

Ergo, as you probably expected, the loss of employment has occurred entirely in the private sector, as Uncle Sam grows more bloated each day. If you happen to be in the private sector, it also might not psych you up too much to know that the average pay per federal worker in 2009 was reportedly $75,419, while per capita average annual income across the U.S. is only about $36,000.

Private employment growth must resume soon, or the U.S. risks falling prey to the same plague that has been consuming the welfare states of Western Europe for decades. And the way to spark private employment growth is certainly not by government growth.

The U.S. has just experienced its second lost decade. And the powers that be in Washington have us on a course that virtually guarantees the next ten years will also be a loss.

The Other Oil Play You Simply Can't Ignore

The biggest economic shift of our time is under way.

Cheap and easy oil is gone for good. And given our addiction to low-cost oil, the results are about to put the squeeze on your pocket book.

Increasing prices will have a huge effect on every aspect of your life, from the price of your food, to how much you'll pay at the gas pump, to the cost of heating and cooling your home.

Nearly everything in our lives revolves around oil.

While demand for oil continues to grow, we are coming to the realization that like all other resources, oil is finite and output is now in terminal decline.

This has the oil industry stuck on a treadmill, running faster just to stand still.

The Globe and Mail reports, "Conventional oil supply (the type of low-cost fuel you can afford to burn) has not grown since 2005, and may never grow again."

The U.S. Department of Energy has concluded that 2009 was the last year that oil production will keep up with consumption. And if the government is making this admission, it's safe to say the situation is far more urgent.

On top of this, as the standard of living for people in developing and emerging countries increases, so does their consumption of oil. A recent article in Reuters said that over 1.3 million vehicles were sold in China during the month of September alone, up 77.8% from the same time last year.

Trading bicycles for brand-new oil-burning cars is a trend that is quickly gaining momentum.

And so, the question becomes: if demand is already outstripping supply, where will we find the oil needed to satisfy the billions of new consumers just coming online, to protect our own lifestyle, and to avoid a dangerous global tug-of-war over this dwindling precious resource?

As dire as this situation sounds, the truth is, we're not running out of oil. Far from it, in fact. What we are running out of is the supply of cheap, conventional oil we've grown accustomed to. And for investors, this has opened a whole new window of opportunity.

The solution for tomorrow's growing demand will be solved by the industry's other oil play — namely Canada's massive oil sand deposits.

Marin Katusa, a top money manager, investment advisor, and Casey's own senior energy expert, recently explained the promising outlook for the Canadian oil sands.

Marin's answer as to why oil sands is two-fold:

1. The easy oil is not so easy anymore.

2. The cost of oil sands production has decreased because of the improvements in technology.

And as for why he likes Canada (and particularly Alberta) over other sources of oil sands, the answer is simple. Canada has the best upside for oil sands in the world, with readily available infrastructure and a stable political system. Venezuela and Russia lack important criteria, infrastructure, and political stability.

This chart from Statistics Canada tells an interesting tale. In 2008, investment in Alberta's oil sands reached a record high of $19.2 billion, a 14% increase over 2007, even after oil prices fell below $34 per barrel. Now that prices are close to $80, development and research will only increase in this proven and reliable resource.

Another noteworthy plus for Canada is a change in the accounting principles, providing the majors with a more favorable financial uptick from the oil sands reserves. Marin feels, within the next few years, that this will offer a tremendous upside for the majors, with excellent growth potential.

Another noteworthy plus for Canada is a change in the accounting principles, providing the majors with a more favorable financial uptick from the oil sands reserves. Marin feels, within the next few years, that this will offer a tremendous upside for the majors, with excellent growth potential.

In the next year or two, the price of oil will be dramatically higher.

Stock Market Setback Soon?

Those of you who have been with us for some duration will recall that Doug Casey (Casey Research founder and my favorite partner of all time) periodically experiences what we call “guru moments.” These involve his making declarative statements about some pending market event that, more often than not, then comes true.

None of us, not even Doug, know where these insights come from – and I can’t even tell you how it is that we can discern the difference between a passing remark and a guru moment. We just can.

As far as I can tell, the only two members of the team with the ability to spot one of these moments are myself and Louis James, head of our metals division and editor of our weekly Conversations with Casey. I suspect this is so because we talk most frequently with Doug. Perhaps, I can only theorize, our regular conversations allow us to subconsciously recognize when Doug’s level of conviction about some pending market event rises substantially above the normal range of expression?

While not all of Doug’s guru moments come true, his batting record, if we could reassemble it, is well above average – which is why Louis and I sit up and take notice when one occurs.

One that comes readily to mind occurred in the middle of December of 2004, when Doug told me that there was going to be a rally in the dollar. Which was decidedly contrarian because over the two-year period prior to that conversation, the dollar had lost 57% against the euro and pretty much everyone was bearish about its near-term prospects. Doug’s guru moment became a lead article titled The Dollar Bounce for the January 1, 2005, edition of our Casey’s International Speculator.

But now, not despite the dollar being all over the world's media as a disaster, but because of it, it's probably time for a bear market rally. By definition, the masses are trend followers, not contrarians. Regardless of what the long-term fundamentals of a currency may be, in the short term its price is set by the psychology of buyers and sellers. Right now everyone knows how badly it's done, and they're all sellers. As I write, the euro has hit a new all-time high of $1.36 against the dollar.

Everyone and their dogs have finally become aware of the dollar's problems. Therefore I suspect that it's almost time for Business Week to run a cover story projecting the death of the dollar, ringing the bell for a temporary bottom. But the dollar is still (for the moment) the world's currency. The recent anti-dollar hysteria will wear off and sellers will buy back a lot of dollars, simply because the dollar is still, for all its faults, a liquid and convenient holding. (Doug Casey, “The Dollar Bounce,” January 1, 2005)

Almost immediately following that guru moment, the dollar took off on a year-long run, as you can see in the chart here.

As to how he does it, some time ago I came to the conclusion that a lifetime of studying markets and constant reading – combined with a powerful natural intelligence – allows Doug to subconsciously recognize useful patterns. When those patterns converge in a certain way, Doug can intuitively identify an important near-term consequence.

As you might suspect from this long warm-up, Doug has just had another guru moment. It is that the U.S. stock market is approaching a cliff.

While only time will tell whether or not Doug’s concern is justified – typically, we don’t have to wait long – I mention this here and now because it’s important to think through the investment implications of another stock market crash.

The following chart, drawn with tools available on Bloomberg.com, shows the S&P 500 over the past five turbulent years, plotted against the GDX index of large gold producers, DXY, the dollar index, and GLD, a proxy for gold bullion.

While the situation today is much different from 2008, when the last crash occurred, the potential investment consequences are worth thinking through.

For example, in the 2008 crash the stock market got pretty beat up, but the large-cap gold stocks got positively hammered. And the junior Canadian exploration stocks (not shown) got nuked. Gold bullion also got beat up, but not nearly so badly, largely trading on the flipside of the dollar, which rallied. As you can see, while the stock market has since come back, both it and the dollar remain stark underperformers to gold and gold stocks.

Doug’s guru moment aside, I would have to say that the rest of the team’s views on the broader U.S. stock market is one of ambivalence. Based solely on traditional financial metrics, such as the P/E ratio and dividend yields, the stock market is not particularly overvalued. And, besides, the stock market is really a collection of individual issues – and so in that collection are almost always to be found good companies selling at good prices. In addition, there is a lot of money on the sidelines at the moment that is not earning any real yield, money that is available to prop up stocks, given even a modicum of encouragement.

Yet there is a legitimate concern that the P/E ratios, which have improved considerably over the last year, have improved largely because of deep cuts in staff and other expenses. In most cases, it is decidedly not due to an increase in revenues. With the bulk of the cost cutting now behind corporate America – and as the unemployment report shows, companies made a lot of cuts – it becomes unlikely that quarterly earnings reports will continue to surprise on the upside. That greatly increases the risk that earnings will stall out and any further surprises will point to the downside.

On that front, David Rosenberg of Gluskin Sheff made the following observation in his daily briefing this morning.

We were struck by the Alcoa report, which is usually the bellwether for the entire reporting season — a penny a share for a company that supposedly has a link to the “booming” global economy (not to mention Chevron’s warning). This is a company that during the 2003-07 up-cycle never reported anything less than 16 cents a share (the best was 88 cents). So like everything else, the “new normal” in a post-bubble credit collapse for this corporate giant is one cent.

If this pattern holds true for the other companies due to release their earnings in the near future, then that alone could be enough to cause Doug’s prediction to come true, and sooner rather than later.

If and when trouble occurs, I would suspect the following will occur:

1. Gold and silver bullion prices will fall. For a brief period of time, "the market" will read a possible deflationary outcome in the crash. Deflation, the market reflexively believes, is bad for tangibles, and so there will be a sell-off. I do not believe, however, that the sell-off will be very long in duration or particularly deep. That's because...

2. The dollar will rally and then fall. In my article on Monday titled "What the Deflationists Are Missing," I commented that the big money increasingly shares our view that U.S. politicians, in their constant quest for reelection, will use the government’s fiat monetary powers as aggressively as needed to help stave off a further erosion in the economy prior to the November elections.

Thus, while it will be natural for investors to move money out of equities and into "safe" investments during a crash, which will boost the dollar, the follow-on monetary implications of the crash will be clear for all to see. Those implications, simply, will be for the taps on the money supply to be opened even wider.

3. Gold stocks will fall, and probably fairly hard. In the last go-around, there was a huge demand for redemptions on the part of investors, which in turn forced money managers and other institutions to simply dump everything they could get a bid on.

The devastation in the junior mining stocks was particularly bad, in good part because some big players had moved into the space and owned small stocks in big quantities they had no business owning. While there has been a resurgence of interest in the gold stocks, of all sizes and descriptions, over the past year, I don't see the same overinvestment in the sector as heading into the 2008 crash. And I don’t see nearly so much uncertainty about where the economy is ultimately headed: towards a serious inflation. In the last crash, there were more deflationists than inflationists stalking the land.

This time around, the added pressure on the dollar from an inevitable new wave of government spending programs should cause both bullion and precious metals stocks to bounce back quickly. Looking at the chart above, you can see that in the 2008/2009 crash, gold stocks turned back up before the broader market – a phenomenon we have witnessed in similar market conditions in the past – and then outpaced the broader markets, by a wide margin, to the upside. For the reasons just mentioned, this time the bounce should come even sooner and likely be more pronounced.

What to do? It really boils down to your personal temperament. If your portfolio is significantly overweight in precious metals stocks at the moment – personally, I would define “overweight” as having more than 25% of a portfolio in precious metals stocks – and if a serious loss in those stocks would cause you a great deal of anxiety, even if only over a relatively short period of time (1 to 3 months?), then consider lightening up for a bit. Park some money in cash, and be prepared to buy back your favorite stocks in any serious setback.

As for precious metals bullion, if you have a trader’s mentality and are heavily invested in one of the electronic forms of gold, moving some of that money into cash on a temporary basis with an eye to buying it back cheaper might work out. For physical bullion you keep close at hand, however, I wouldn’t bother going through the hassle and expense of selling in order to buy back later.

At this point the risk of not owning precious metals and related investments is far higher than the risk of owning them. So, you should view any possible broader stock market crash with a certain amount of tranquility, even if your brokerage statement temporarily disappoints.

That's because while others will be wondering what to do in the next crash, you’ll already know – buy more precious metals stocks and bullion.

And that, dear reader, is that for this week. See you on Monday!

David Galland

Managing Director

Casey Research

0 comments:

Publicar un comentario