by: R. Raynovich

October 25, 2009

In investing it pays to be calm, scientific, and objective. Here at the Rayno Report we believe in looking at and analyzing data. You're heard about gold the "barbaric relic," yes? The asset that pays no interest? For years I've been perplexed by the mainstream media's skepticism of the gold rally, so I decided to look more closely at the data.

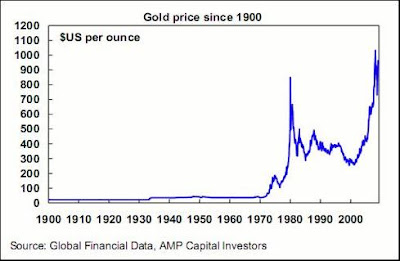

It turns out that public perception and mainstream TV commentators have had things entirely wrong. Data shows that gold has been outperforming equities for the last 40 years. Gold today is at $1,050. That’s 30X times the gold price of $35 in 1971, when the United States went off the gold standard. That represents a 3,000% gain. The Dow Jones Industrial Average (DJIA) in 1971 traded around 900. It’s now 10,000. That’s a gain of about 10X, or 1,000%, over the same period of time. Gold has outperformed the DJIA by a factor of 3 since coming off the gold standard.

For whatever reason, the mainstream media, the government, the investment banks, and even many Americans appear to have a hard time accepting this. Maybe it's because it's harder for them to make money trading gold than it is floating speculative IPOs. For now, you can ignore the clucking of the TV commentators who fear gold is a “dead asset” that pays no interest. Not even close.

In fact, they are still getting it wrong. Mainstream "pundits" like Larry Kudlow and Henry Blodget still scoff at the gold rally, raising eyebrows. It's as if they don't understand that politicians want to print money.

Let’s drive home the point. Let’s say the day the U.S.went off the gold standard, in 1971, you invested $100,000 in gold and $100,000 in the DJIA. The gold portfolio today would be worth about $3 million. The portfolio of DJIA-indexed stocks would only be worth $1 million.

What gives? How did this happen? From 1880-1935, the United States was locked on to the gold standard at a price of $21/ounce. Those were the days of monetary stability, fiscal discipline, and sanity. Because the U.S. currency was backed by gold, it meant that the government could not randomly print money when it felt like it. It needed to acquire more gold before it printed money.

To make things more convenient, the FDR administration, under Executive Order 6102, confiscated gold by making it illegal to own in 1933 (see here (.pdf)).

True story. Amazing thing, isn’t it? Well, it got worse. After buying gold from the public at $21 in 1933, the government revalued gold against the U.S. Currency at $35 -- 40% higher. Neat trick eh? Force folks to sell you something and then immediately mark the books for a 40% gain. Good work, if you can get it.

Having a gold standard causes real problems when you are in a fiscal mess. It means you cannot print money to alleviate debts, because a gold standard means that your currency "anchored" to gold. It installs monetary discipline, which politicians absolutely despise. So, in 1971 Nixon, causing shock and awe around the world, cancelled the gold standard, essentially ending the Bretton Woods system of global currency standards that had existed since 1944. Oddly, market prices prior to the end of the gold standard had been gradually creeping up prior to the “Nixon Shock,” almost as if people “knew” what was going to happen.

Since 1971, gold has been allowed to float by “market prices” and without a gold standard has essentially allowed an entire new economic era of fiat money, famously championed by former Federal Reserve Chairman Alan Greenspan who called gold a “barbaric relic.” What’s interesting is that the barbaric relic is now having its day. It’s almost as if the gold market is flipping Alan Greenspan the bird. Since the elimination of the gold standard, it has surged massively.

Even with these volatile spikes and collapses (make no mistake about it, short-term gold moves can be violent), the long-term trend has been a steady march up. Even when the gold price hit its bear-market low in 2000 at $260 per ounce – when tech stocks were the rage and gold was at its nadir in the public’s investing mind – it was still 7X higher than it was on the gold standard. This make sense. Inflation was low. The tech boom was increasing productivity and the world thought we’d entered some sort of utopian “new paradigm.” Sentiment about gold was at a low. Gold has, in fact, always served its purpose as a store of value in the face of fiat money. Yes, there was a decade in which gold did nothing – the 1990s. That’s called a bear market. Just as equities have done nothing for the last ten years. But if you look at a longer series of data – the last 40 years – it’s starting to look like gold has a better track record.

Is this really so surprising? I think it makes perfect sense. Gold’s “real market” performance – in the post gold standard regime -- shows that in a fiat money system, the government will print money irresponsibly, and gold will serve as protection against this. A 3,000% gain does miracles for insuring against inflation. (The dollar has declined approximately 90% in value since the end of the gold standard). Remember how much a Coke was in 1979? It's interesting that since 1971, gold has been a better inflation hedge than equities.

Now, I still believe in equities. Investing in great companies is a good idea. But I think the track record of fiat money and gold shows that a diversified portfolio must include gold. The data shows that gold is an essential asset class for most investors because of its power to preserve value in the face of currency debasement. It’s your insurance against irresponsible government fiscal policy. The government prints money, and gold goes up. In the days of a non-gold standard, that’s almost guaranteed.

0 comments:

Publicar un comentario