There, In The Distance, A Black Swan

by: The Heisenberg

Summary

- Suddenly, one tail risk at the top of everyone's 2018 "biggest worry" list doesn't seem so far-fetched.

- But as usual, there's more to the discussion than what you'll get from generic commentary, so here's the nuance.

- And boy, oh boy am I glad I remembered what Chris said in December.

- But as usual, there's more to the discussion than what you'll get from generic commentary, so here's the nuance.

- And boy, oh boy am I glad I remembered what Chris said in December.

"You know all those times you've heard people reminisce about the Bernanke tantrum and the great bund tantrum of 2015? Yeah, well this is what a tantrum episode feels like."

That comes from Friday evening's "bad dream". It occurred to me on Saturday morning that a lot of readers might not actually remember those episodes, and even if they have some recollection of the events having occurred, they might not remember exactly what the fallout was.

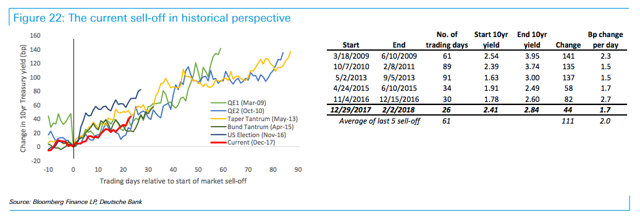

So, in light of that consideration, I thought you might be interested in the following chart and table from Deutsche Bank, which depicts recent Treasury selloffs and quantifies their depth.

Note: If you're curious as to the seemingly paradoxical connection between Fed QE announcements and Treasury selloffs, you might want to check out my buddy Kevin Muir's short Thursday note here.

Note: If you're curious as to the seemingly paradoxical connection between Fed QE announcements and Treasury selloffs, you might want to check out my buddy Kevin Muir's short Thursday note here.

(Deutsche Bank)

Notably, what the red line there shows is that despite having gotten materially "worse" this week, the magnitude of the nominal rise in 10Y yields is actually not out of step with previous episodes. Additionally, it would appear that this has considerably more room to accelerate if recent history is any guide.

That goes some ways (albeit simply citing historical precedent is far from definitive in this case) towards answering a question I posed first thing Saturday morning. Namely this:

We're kind of back in a position where everyone is asking for predictions again only now, everyone wants to know how far markets will fall, whereas just a week ago, the question was how high markets will rise.

Of course, I was referring to equities there, but because the proximate cause of the stock market decline was rising yields, we might has well view the two as inextricably linked for the time being. That link is precisely what I tried to communicate on Thursday (i.e., one day before the slide in stocks really accelerated), when I quoted Bloomberg's Richard Breslow who said the following this week about the driver of equity returns in the near term:

This is no time to be analyzing individual stocks. Whether they go up or down from here will be index-wide and dependent on bond yields and the dollar, little else. Big, not little, canaries.

Yes, "big, not little canaries" and the Treasury market is the "biggest" canary around; assuming the idea of a "canary" being "big" isn't a misnomer in the first place.

Anyway, folks are already out revising up their year-end targets for 10Y yields. Deutsche Bank, for instance, lifted theirs from 2.95% to 3.25%. This should go without saying, but one of the questions here is what this ultimately means for the curve. In the (very) short term, it looks like the momentum crowd might have gotten the call right on the Treasury selloff, but in assuming the consensus (i.e., bear flattening as the Fed hikes against a backdrop of still-depressed long rates), they might have been offsides on the curve. How they "correct" that view could have implications for where 10Y yields go from here. Here's Deutsche Bank:

Our analysis of the HFRX Macro/CTA Index suggests that momentum-following strategy funds have a significant positioning bias toward bearish flatteners. The key issue now is when and how these flattening positions will be unwound. We are inclined to think that it will come in the form of CTAs adding more short positions in the 10yr, rather than reducing their shorts in the front end. A switch in strategy by momentum traders from bearish flattening to bearish steepening could cause more selling in Treasury futures, kicking rates another notch higher.

About that bear steepening: it's something you need to watch pretty closely. It is not at all difficult to make the case for a steeper curve. That doesn't mean you'd be right, it just means that it's not hard to make an ostensibly plausible case. I mean, for one thing, Treasury's borrowing needs are rising in part due to the deficit-funded tax cut in the U.S. and that comes at a time when the Fed can effectively exert some level of control over the long end via balance sheet rundown. Bottom line: There's more marketable supply and that supply will now need to find a market clearing price. That could be bearish for Treasurys. Additionally, bullish bond shocks from Europe and Japan are bound to fade as the ECB moves to normalize and the market begins to test the BoJ's mettle in earnest amid improving econ data in Japan and the first signs that the country's deflationary mindset might be breaking. Finally, Friday's average hourly earnings print (and if you had to point to one thing that catalyzed the decline in stocks, that was it) seems to suggest that inflation pressures are building stateside.

There's another argument for a steepening view and it was articulated on Friday by the above-mentioned Kevin Muir as follows:

In the coming years as the global economy strengthens, bond markets will increasingly price in hawkish monetary policy shifts. But Central Bankers will resist them. We have seen this already with both the ECB and the BoJ. They will err in raising more slowly than the market wants. Over the past couple of years, the Federal Reserve has obviously been an exception. They have gotten somewhat ahead of the market. Yet that’s now changed. Trump’s election was a momentous signal that populist policies are what the people want. And what does that mean?

More inflation.

But inflation is exactly what sends bond prices lower and previously caused Central Bankers to tighten. Well, I am a seller that Central Bankers throughout the world tighten anywhere near as much as bond markets are worried about. And ultimately that’s what will cause yield curves everywhere to steepen, eventually hitting record wides. Yup - that’s what I believe. Before this coming bond bear market is over, yield curves will hit record steep levels.

And see therein lies the problem. If you're say, the Fed, what do you do if inflation comes calling? If rate rise ends up being a product of higher breakevens, well then the black swan cometh. The tail risk is realized. There's no "right" answer. Consider this from Deutsche Bank's Aleksandar Kocic, out on Friday:

However, and this is the second point here, higher rates mean moving closer to the tail risk strike. This is the domain of negative convexity exposure of the central banks – a scenario that has no adequate policy response. Such an outcome would represent a choice between allowing rampant inflation with a possibility of either triggering a bond unwind trade or causing a stock market crash and possibly recession. Because of that, in the higher rates scenario, monetary policy would be a wild card.

Right. And although Jerome Powell is a policy veteran, when it comes to being Fed Chair, he is by definition a rookie. Keep in mind that the quandary presented in that excerpted passage would be playing out against balance sheet rundown. Additionally, and this may or may not be relevant, one has to wonder what would happen to rates vol. if all of that coincided with a decision on the part of market participants to start hedging whatever MBS exposure they take on as the Fed lets those assets rundown.

The hilarious thing about all of this is that despite having a "tail risk" character to it, and despite there being all manner of caveats and embedded contingencies, it really isn't far-fetched at all.

In fact - and I didn't mean for this to end up being the punchline, but boy, oh boy am I glad I remembered it because it works out great - all you need to tie all of this together is one quote from Aviance Capital Management's Chris Bertelsen, who spoke to Bloomberg for an article dated December 15.

Think about what happened on Friday in terms of how stocks reacted to the Treasury selloff which worsened as soon as the upbeat wage growth hit the wires and then recall this from Chris with that in mind:

All you need is an [...] increase in wages [...] and then at the end of a couple weeks you’re going to say, 'Oh my gosh, what happened? The Nasdaq is 5 or 6 percent off.'

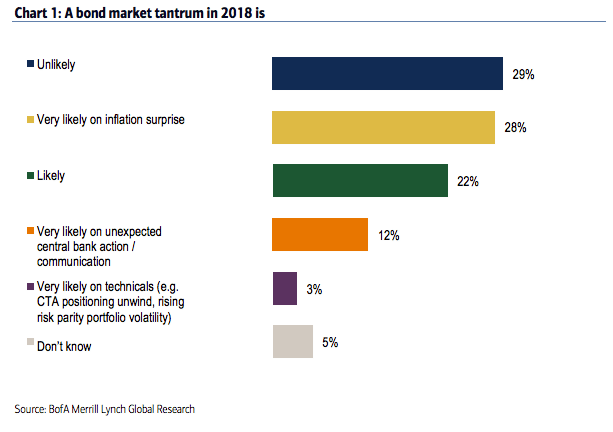

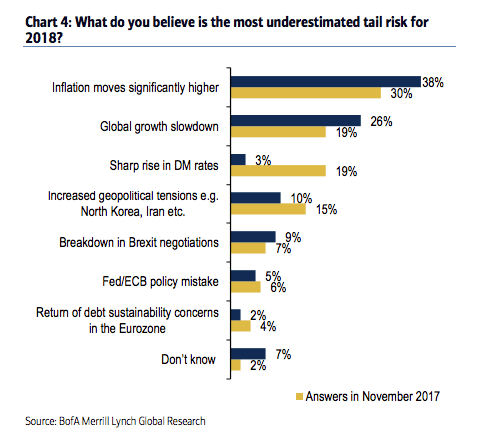

I'd drop the proverbial mic there, but instead, I'll leave you with two visuals from the December edition of BofAML’s FX and rates strategy fund manager survey. I trust you'll see why these have become markedly more relevant in the two months since...

0 comments:

Publicar un comentario